EURUSD. US CPI Report (18 October 12:30 GMT)

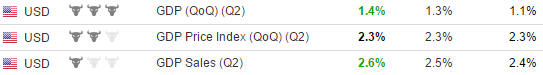

The latest US data remains on a very good level with a positive dynamics – both CPI and year-over-year GDP are increasing faster than the expectations but they still remain lower compared to the target values

Due to the latest US labor market data (NonFarm data is over 150,000 for the several months in a row and that is a positive sing)

market participants believe that there will be at least one refinance rate hike and the value of US Dollar will be significantly increased.

The latest CPI data:

If the actual CPI is above the forecast yet again it will have a massive positive impact on US Dollar and traders we get addition sign of a possible rate hike.

EURUSD chart:

According to the indicator of technical analysis “Bollinger Bands” downward trend starts to accelerate on EURUSD D1 chart as the lower line of Bollinger Bands indicator was breached. “CCI” proves this hypothesis. What is more, all the fundamental factors favor the US Dollar. The only possible issue are the US president elections which will be in the nearest future and uncertainty behind it.